3 Things: Wealth Scale, the Generations, & People in the Wild

Where are you on this scale?

1. In “The Three Levels of Wealth,” Ben Carlson tries to determine where most Americans might find themselves on Stewart Butterfield’s scale:

Level 1. I’m not stressed out about debt: People who no longer have to worry about their credit card debt or student loans.

Level 2. I don’t care what stuff costs in restaurants: How much you spend on a particular meal isn’t impacted by your finances.

Level 3. I don’t care what a vacation costs: People who don’t care how expensive the hotel is or which flight they go on.

Ben shares some interesting charts with his readers, including this one:

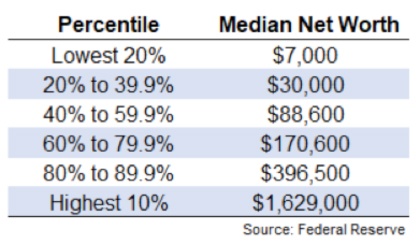

“According to the Federal Reserve, as of 2016, the average net worth of American families is just shy of $100,000. But the median wealth for the top 10% is over $1.6 million while the top 1% holds almost 40% of the country’s wealth.

The Fed also broke out the net worth figures by various percentiles:

A view of the generations

2. An oldie but goodie on Thematic Investing | Future Reality, by Bank of America:

People in the wild are different from people on paper

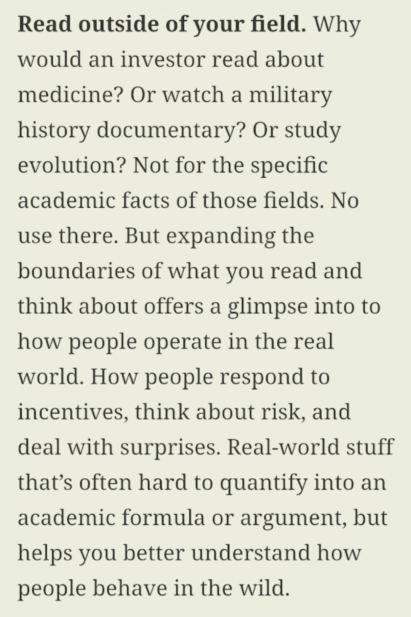

3. Real World Knowledge vs. Book Knowledge by Morgan Housel

Bonus if you’re still reading this post

Bored? Let's play a game!

Retweet once you see the cat.

I swear this is not a trick. It's there in full plain sight. pic.twitter.com/kE6NwKgNwt

— Michael Clarke (@Mr_Mike_Clarke) August 4, 2018

SAGE Serendipity: Are you one of those people who covet the same seat in the meeting room, or hate when someone’s in your favorite booth at a restaurant? Quartz.com’s Creature of Habit column, The psychology behind why you always want to sit in the same seat, will help explain your quest for personal territory.

SAGE Serendipity: Are you one of those people who covet the same seat in the meeting room, or hate when someone’s in your favorite booth at a restaurant? Quartz.com’s Creature of Habit column, The psychology behind why you always want to sit in the same seat, will help explain your quest for personal territory.

Secure Document Sharing

Secure Document Sharing