Open Enrollment Time: Part 1 – Life Insurance

Sheri’s take: There’s strength in numbers, especially in having a number of well-informed alliances to supplement our own financial know-how. Mark Maurer, CFP®, MBA, president and CEO of LLIS is one such alliance we’ve long maintained – because protecting the wealth you’ve already got against life’s many risks is essential to your total wealth interests.

Thanks to Mark and his LLIS team for sharing this guest commentary on insurance coverage worth considering during the fast-approaching fall open enrollment periods. For 2018 healthcare coverage, that’s Nov. 1 – Dec. 15, 2017. For Medicare, it’s Oct. 15 – Dec. 7. Other enrollment windows vary but, just as we use Daylight Savings Time as a prompt to change our smoke alarm batteries, fall open enrollment season is an excellent time to review your wider insurance needs, including group and individual life and disability insurance.

As always, if this commentary generates questions about your own circumstances, please be in touch with us for a personalized conversation.

Open Enrollment Time! Choose Wisely

(Part 1 of 2: Life Insurance)

By Mark Maurer, CFP®, LLIS

Ahhh, fall. That time of year when the temps start dropping, the leaves start changing, and we start thinking about our plans for the year ahead – including our health insurance plans. But your health coverage isn’t the only risk management worth considering. As long as you’re already in an insurance-planning frame of mind, life insurance and disability insurance are two group benefits that often get overlooked as we tend to make assumptions like, “It won’t happen to me,” or “I’m healthy, I don’t have to start worrying about this yet.”

Life insurance: No time like the present

Today, let’s look at group and individual life insurance. When was the last time you’ve thought about life insurance? If it’s been quite a while (if ever), here are a few reasons why time is of the essence:

- Dying is expensive. The average funeral costs $6,000-11,000. Tampa (home to LLIS) is at the lower end; New York City is at the higher end. Cremation services average $3,000-4,000. And that doesn’t account for end-of-life expenses, which are typically highest in the last six months of life: about $18,500.

- It may take time to get insurance in place so it’s best if you don’t put off weighing your options until you imminently need them.

- If you’re going with group coverage during open enrollment and you don’t name your beneficiary(ies) in time, the law will determine who receives insurance proceeds in case of death.

- Outside of open enrollment, group plans may limit your ability to change coverage only at life events like a marriage or a child. (With individual policies, you should be able to change coverage and/or beneficiaries at any time.)

Life insurance during open enrollment

Let’s first define the two types of life insurance you may have available to you through work:

- Employer-paid group life insurance

- Employee-paid supplemental group life insurance (SAGEbroadview note: See Mark Maurer’s previous guest post on this subject, “Making the Most of Supplemental Group Life Insurance.”)

Group life insurance can be one of the most valuable benefits your employer may offer. It’s not uncommon to find offers of $500,000 in coverage for the monthly cost of one barista-prepared coffee confection. And sometimes your employer will even provide it for free.

While you’re considering any group options available, it’s also a good time to consider individual life insurance to supplement or replace employer-paid insurance. (In fact, according to the American Council of Life Insurers, only 44% of all life insurance policies in 2015 were through groups, which included employers, places of worship, and other associations).

Here are some questions to mull over as you review your life insurance options:

- Are you considering coverage for retirement years? Remember, upon retirement, you’ll probably lose your employer-provided life insurance. You may be able to convert your group policy to an individual one, but it may cost significantly more.

- Does the group coverage actually cover your needs? Here’s our condensed death benefit calculator to help you and your financial advisor estimate your needs.

- How healthy are you? If you’re relatively healthy, paying for supplemental group coverage may not be warranted. Conversely, if you have a serious medical condition, adding/keeping supplemental insurance through your employer may be a good idea. (Your advisor can collaborate with us to help you assess your insurability based on any particular conditions you or family members may have.)

- Are you considering a career change or switching employers? Again, group coverage is tied to your job; it may or may not cost-effectively transfer to an individual policy.

- Are you searching for a basic policy? Group offerings are usually quite limited. If you want more choice and a policy tailored to your individual needs, a group policy might not fit the bill.

- Do you have a large family? An individual policy supplemented with employer-paid coverage may be your best bet.

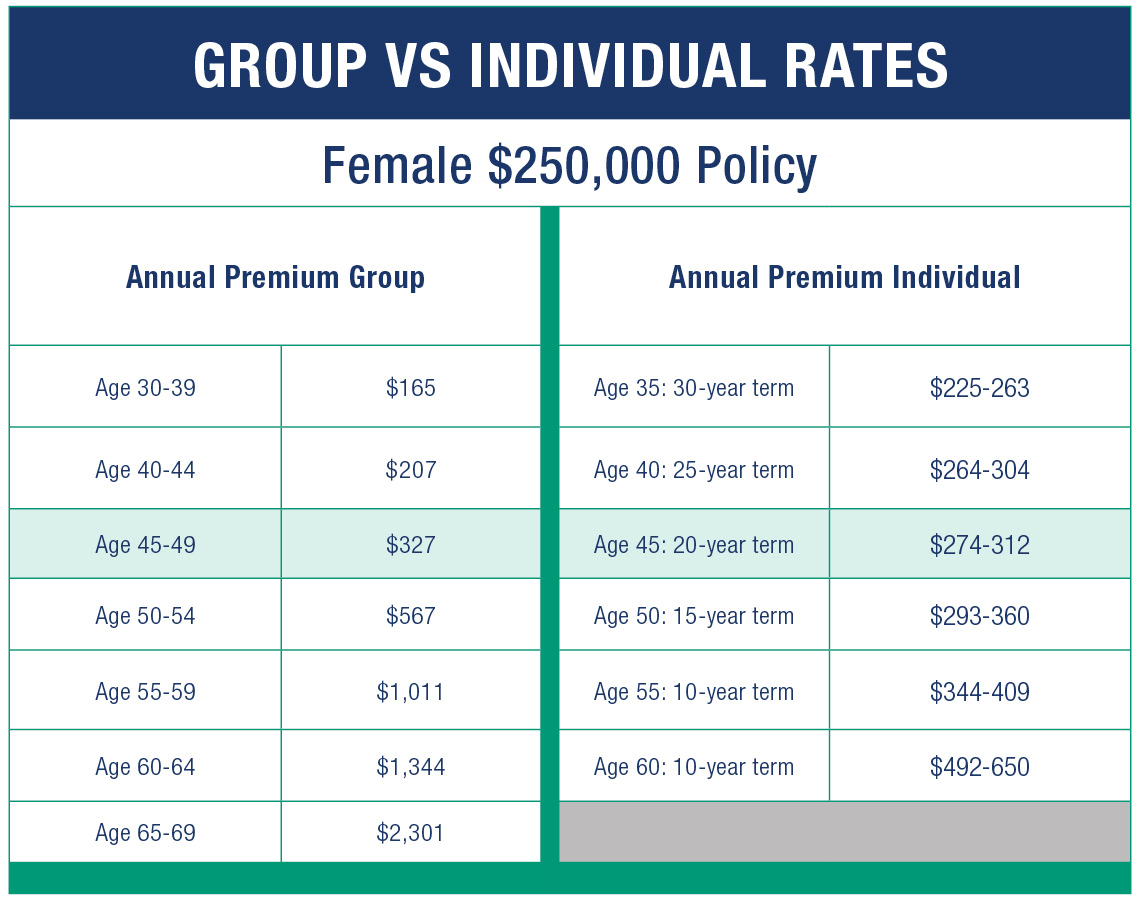

- How old are you? The cost of life insurance rises as we age, and group rates can be substantially higher than individual rates at certain points.

In addition to your employer-paid group life insurance, you may have the opportunity to self-pay for supplemental group coverage during open enrollment. Here is an example of what to expect among non-employer-paid life insurance options:

Next Up: Disability insurance during open enrollment

Clearly, there’s lots to think about with respect to your life insurance, so I’ll save the conversation on disability coverage for my next post. Since your ability to earn a living is often your greatest asset, protecting against disability is essential for most families, so be sure to come back next week for a look at the key considerations there.

SAGE Serendipity: The Nobel Prizes are being awarded this week. The Prize in Physiology or Medicine went to Jeffrey C. Hall, Michael Rosbash, and Michael W. Young for their discovery of “molecular mechanisms controlling the circadian rhythm“. “The biological clock is involved in many aspects of our complex physiology. Their discoveries explain how plants, animals and humans adapt their biological rhythm so that it is synchronized with the Earth’s revolutions.” When he was interviewed Jeffrey C. Hall praised the role of the humble fruit fly, “the key fourth awardee here is … the little fly”.

SAGE Serendipity: The Nobel Prizes are being awarded this week. The Prize in Physiology or Medicine went to Jeffrey C. Hall, Michael Rosbash, and Michael W. Young for their discovery of “molecular mechanisms controlling the circadian rhythm“. “The biological clock is involved in many aspects of our complex physiology. Their discoveries explain how plants, animals and humans adapt their biological rhythm so that it is synchronized with the Earth’s revolutions.” When he was interviewed Jeffrey C. Hall praised the role of the humble fruit fly, “the key fourth awardee here is … the little fly”.

Secure Document Sharing

Secure Document Sharing