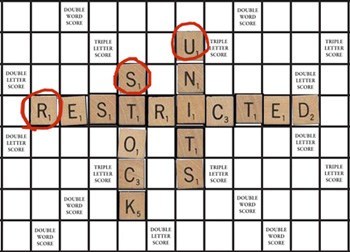

How Do You Spell “Vested RSU”? We Say: S-E-L-L

Vested RSU’s? – Sell

Especially when it comes to company stock plans, acronyms abound. Someday, I’m going to invent a secret decoder ring that translates each one into something approaching English. I’ll make a bazillion dollars and retire. In the meantime, let’s decode one important acronym that can sometimes spell confusion for busy professionals: Restricted Stock Units (RSUs).

RSUs, Decoded

Many corporate executives and valued employees may be receiving vested RSUs around this time of year. As described in this article by Wealthfront’s Andy Rachleff, “Why You Should Treat Vested RSUs as a Cash Bonus,” vested RSUs are taxed as follows:

- You will be taxed on the distributions when the vesting occurs.

- The distribution is treated as ordinary income.

- The basis for unsold units is set as the share price on the day the shares are vested.

Waving our secret decoder ring over these points, this means:

Not selling your vested RSUs is the same as if someone handed you an annual bonus, and you used it to purchase a bunch of company stock at current market prices that same day, “just because.”

In other words, if you wouldn’t have made such a stock purchase otherwise, it doesn’t make sense to do so simply because your RSUs have vested.

What to Do With Your Vested RSUs

Combine the arbitrary nature of the transaction with the classic wisdom of minimizing risk by diversifying (not concentrating) your wealth, we at SAGE typically advise clients to sell RSUs immediately upon vesting.

Bottom line, it rarely makes sense to further concentrate your wealth in your employer’s stock. First, you already depend on that same company for your livelihood. Second, you may already own plenty of company stock through one or more executive compensation programs.

Instead, consider using the proceeds to pay off debt or fund your goals – that is, use it on something of meaning to you. Or you can use this fresh cash to rebalance your overall portfolio in line with your target asset allocation, thereby reducing the usual trading costs to do so.

By selling your vested RSUs, you gain accessibility to new money for realizing your personal goals. Now there’s a bonus worth receiving!

Secure Document Sharing

Secure Document Sharing