What is a Fiduciary? Demystifying “Fiduciary” Financial Advice

So, have you heard about the Department of Labor’s (DOL’s) new fiduciary rule, now governing the advice you receive for your retirement plan assets? If so, congratulations, you’re in an elite group. Maybe the news would have received wider coverage if the election year weren’t in full swing. Maybe not. As one of my colleagues observed, “Sad to say, ‘fiduciary’ is boring.” The word alone causes eyes to glaze and attention spans to wander.

That’s why we were happy to see motivational speaker Tony Robbins produce a short, genuinely entertaining video in which he “explains ‘fiduciary’ to Main Street.” Check it out.

As Robbins’ video demonstrates, the term “fiduciary” seems complicated and mysterious to most investors. To cut through the confusion, being a fiduciary advisor is really as simple as this:

As a fiduciary advisor, we at SAGEbroadview are legally obligated and personally dedicated to always placing your highest interests ahead of everything else, whether we’re recommending products, offering investment advice or otherwise serving your financial well-being.

Spreading the Fiduciary Word

Robbins interviewed 27 people at a busy Wall Street intersection and found only one who knew what fiduciary meant … and that person was a fiduciary himself. “Something to do with financial services?” was the closest one passer-by could guess. “Something awesome!” said another, “Like it has to have some kind of action behind it.”

Robbins concluded: “We’ve got some education to do.”

We couldn’t agree with him more. Just as many investors mistakenly assume that they aren’t paying any fees in their 401(k) accounts (another myth that Robbins debunks), most people assume that every financial professional is required to advise you according to your best interests. After all, what good is the advice otherwise?

Unfortunately, even with the recent DOL ruling, assuming the financial advice you receive is always in your best interest is a huge and often costly misperception. Only fiduciary advisors are so bound.

Finding the Fiduciary Advice You Deserve

So how do you make sure you’re working with a fiduciary advisor? Here, it does begin to get a little muddy … and, frankly, the DOL’s recent ruling only added to the complexity. Here are a few good guides.

- Work with a Registered Investment Advisor firm. Because financial advice is our primary focus, RIA firm representatives (like those of us at SAGEbroadview) are fiduciary advisers. Except for advice related to your retirement plan assets (thanks to that new DOL ruling), advice from brokers, bankers or insurance agents need not be in your best interests.

- Look for the loopholes. Sometimes, advisers are “dual registered,” so they’re wearing two different hats when serving you. This requires them to offer fiduciary advice in some but not all of their engagements with you. As this Wall Street Journal article describes, good luck figuring out which kind of advice you’re receiving at any given time.

- Consider the credentials. One way to differentiate fiduciary advice from a relationship that may come with too many caveats is to look for an adviser who is partnered with organizations that hold their members to even higher standards. SAGEbroadview has long been a member of the National Association of Personal Financial Planners (NAPFA), which requires its members to annually sign and renew its Fiduciary Oath, and adhere to its Code of Ethics. It’s something we’d be doing anyway, but it doesn’t hurt to be part of a community who feels as strongly as we do about the importance of fiduciary care.

The DOL “Fiduciary”?

As touched on above, the DOL rule has introduced new “rules of engagement” on the fiduciary front. The rule’s intent is to obligate anyone who is advising you on your retirement assets to do so in a fiduciary manner, no matter what other roles they may be playing for the rest of your wealth. In practice, until that intent is played out in real life and real courts, it’s too soon to tell whether the rule will strengthen or weaken the true meaning of fiduciary.

We hope the DOL fiduciary rule eventually makes it harder for anyone to ever offer you bum advice about any of your hard-earned wealth. Until then, we recommend sticking to our three considerations above … and being in touch with us anytime we can help you solve any other riddles that may be complicating your financial well-being.

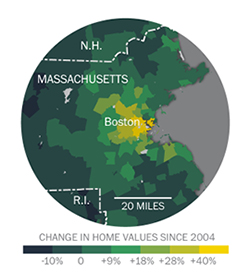

SAGE Serendipity: The Washington Post is running a series, The Divided American Dream. Included in this series is a data map analyzing housing prices before and after the financial collapse. Simply plug in your zip code to see how your community is faring. Check it out – America’s great housing divide: Are you a winner or loser?

SAGE Serendipity: The Washington Post is running a series, The Divided American Dream. Included in this series is a data map analyzing housing prices before and after the financial collapse. Simply plug in your zip code to see how your community is faring. Check it out – America’s great housing divide: Are you a winner or loser?

Secure Document Sharing

Secure Document Sharing