Investment Basics Series: Stocks vs. Stock Funds

How do I decide whether to invest in individual stocks, stock funds or both?

So far in our summer series, we’ve been talking conceptually. As we inch toward the end of summer (bummer), let’s discuss a few logistics.

To put rational theory into practice, we feel most investors are best served by avoiding attempts to pick individual stocks. Typically, the far more efficient approach is to build the stock portion of your portfolio using like-minded, low-cost fund managers to do the heavy lifting for you.

Let’s begin by reviewing the basic tasks involved in evidence-based investing:

- Create your personalized portfolio by using a globally diversified mix of asset classes designed to capture market returns while managing for market risk.

- Locate your holdings appropriately to minimize taxes incurred.

- Periodically rebalance to stay on track.

So far, so good. But if you decided to implement these tasks by investing in individual stocks, you’d be taking on a great deal more work than necessary. Here are some of the actions that a suitable fund manager can perform for you:

- Analyzing each stock, to determine which asset class it fits into

- Tracking it ongoing, and considering adjustments if it migrates into a different asset class (for example, if a small company becomes large)

- Implementing appropriate tax-loss harvesting for the stocks in your taxable accounts

- Applying patient purchasing power to be on the favorable side of most of your trades, so you’ll get the best prices when you buy and sell

- Assessing the latest academic evidence for opportunities to further enhance your detailed understanding of evolving asset class theory

Now, multiply all of the above by thousands of times. For effective diversification, you want to hold nearly every security available within each chosen asset class.

Suddenly, paying the right fund manager a modest fee to do all of this for you starts to make a lot of sense. (You do want to ensure that the fees are modest, and that the fund manager is fully committed to the same, evidence-based investment principles we’ve been describing.)

Beyond the logistics described, there’s another key consideration. To revisit our first post in this summer series, it’s important to remember why you’re investing to begin with: To achieve your personal financial goals, whatever they may be.

By investing in low-cost, evidence-based mutual funds, you can shift your time and energy from the granular details to the big picture. With the additional assistance of an evidence-based adviser, you can concentrate on ensuring that your portfolio is optimized upfront and ongoing for your singular purposes. Particularly when markets are going through their inevitable bull and bear cycles, we believe you’ll stand a much better chance of staying on course if you don’t have to tend to each security’s individual performance.

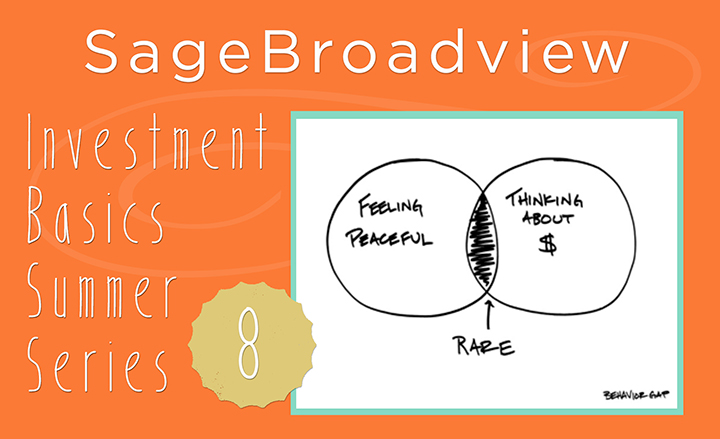

All of this translates to an increased likelihood (although never a guarantee) that you’ll remain in or near that happy, but small intersection illustrated by Carl Richards – that happy overlap between thinking about your money and feeling good about it too. We hope to meet you there!

Win a copy of Carl Richards’ new book, One-Page Financial Plan

As we mentioned in our Investment Basics introduction, send us an e-mail with a question or comment about today’s post, and you’ll be entered to win this week’s drawing for a copy of Carl Richards’ One Page Financial Plan. Happy summer reading!

Sage Serendipity: It’s coming up on Back to School season which means new fun affordable tech gadget lists that can extend past the college dorm! TechHive has a good list including some unique items such as Aquafarm, a fishtank/planter ecosystem.

Sage Serendipity: It’s coming up on Back to School season which means new fun affordable tech gadget lists that can extend past the college dorm! TechHive has a good list including some unique items such as Aquafarm, a fishtank/planter ecosystem.

Secure Document Sharing

Secure Document Sharing