Investment Basics Series: What Is Asset Allocation?

What is asset allocation and why does it matter to you as an investor?

In last week’s Investment Basics Summer Series, we defined asset classes as categories (classes) by which we organize individual securities (assets) that share significant factors. To review:

- There are broad asset classes for stocks, bonds and real estate.

- Within these broad classes, there are narrower ones based on company size and certain business metrics for stocks, and on duration and quality ratings for bonds.

- For each asset class, you can invest in the U.S. market, other developed markets and emerging markets around the globe.

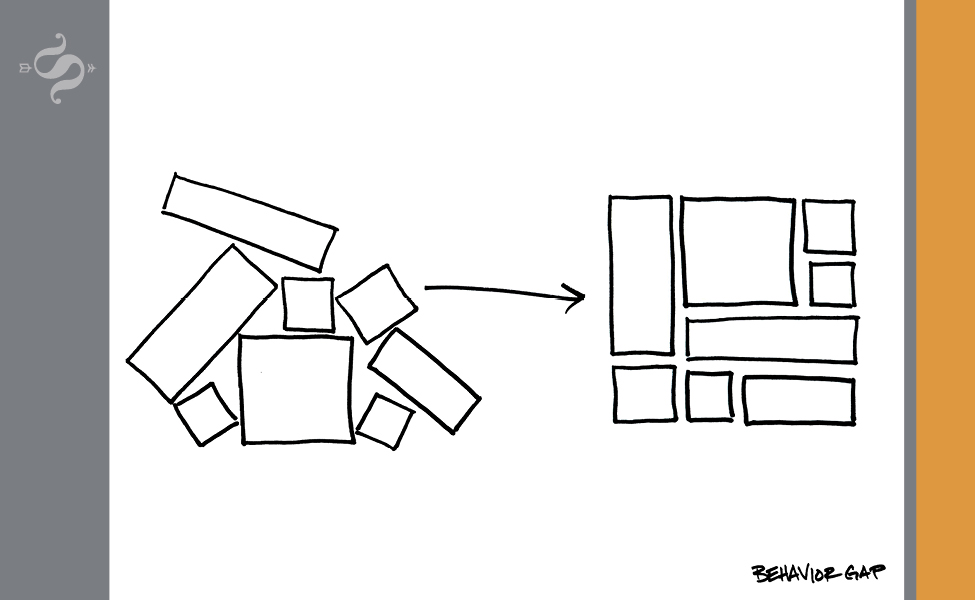

Asset allocation is about combining these individual asset classes in proper measure for building and managing a tailored portfolio that reflects your personal goals and risk tolerance.

Step One: Stocks vs. Bonds – Asset allocation begins with determining an appropriate balance between stocks and bonds, according to your goals. Stocks are useful for seeking more wealth, but they also expose what you already have to greater potential loss. High-quality bonds help you preserve the wealth you’ve got, but they are unlikely to help you build a great deal more of it.

Step Two: Fine Tune the Results – Inside your stock and bond allocations, there are a number of ways we can fine tune the narrower asset classes to improve on expected returns while better managing the overall risks involved. For example investing globally and tilting toward small-cap and/or value company stocks can increase expected returns while minimizing some of your risks. This is accomplished by harnessing the power of diversification.

Step Three: Stay the Course – Once your custom portfolio is built, it’s equally important for your asset allocation to remain balanced as designed, through the years and across shifting markets. This means staying put by: (1) avoiding behavioral temptations to chase hot returns or flee downturns, and (2) periodically rebalancing back to your planned allocations when market performance moves you off-target.

We’ll talk more about these concepts in upcoming posts. For now, suffice it to say that asset allocation is essential to replacing random speculation with individually planned investing.

Win a copy of Carl Richards’ new book, One-Page Financial Plan

As we mentioned in our Investment Basics introduction, send us an e-mail with a question or comment about today’s post, and you’ll be entered to win this week’s drawing for a copy of Carl Richards’ One Page Financial Plan. Happy summer reading!

Sage Serendipity: Serena Williams and Novak Djokovic may not be winning a dancing title soon, but it was fun watching the King and Queen of tennis groove to the Bee Gees’ disco classic “Night Fever” on stage at the Wimbledon Champions dinner in London.

Sage Serendipity: Serena Williams and Novak Djokovic may not be winning a dancing title soon, but it was fun watching the King and Queen of tennis groove to the Bee Gees’ disco classic “Night Fever” on stage at the Wimbledon Champions dinner in London.

Secure Document Sharing

Secure Document Sharing